In the Markets Now: Labor Day Labor Market Update

As we do every fall, we are taking Labor Day as an opportunity to look at some key indicators in the all-important U.S. job market.

A Quick Run-Through of The U.S. Job Market

Labor is perhaps the most important contributor to a country’s economic growth. A healthy labor market allows individuals to trade their time for money, which they then spend back into the economy to fuel further growth (particularly in a consumer-based economy like the U.S.). On the other hand, a weak labor market with high unemployment typically fuels recession. Today, the market is in a delicate place: the U.S. is adding jobs at a sluggish pace, although firing activity and unemployment remain low. Some sectors are booming, while others languish. And the Federal Reserve’s ability to cut interest rates is hampered by their fear of tariff-led inflation. Below are a few key charts we think are worth sharing on today’s labor economy.

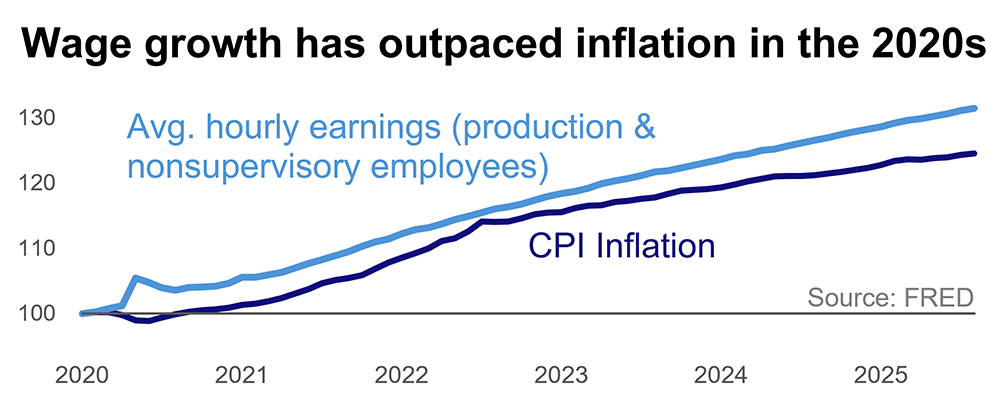

While inflation has been the story of the 2020s, wages for the average worker have actually outpaced consumer prices this decade. Taken together with a low unemployment rate and low consumer debt levels, one can start to piece together why consumer spending and corporate earnings have remained solid amid a healthy amount of macroeconomic uncertainty – and despite a years-long recession in consumer sentiment.

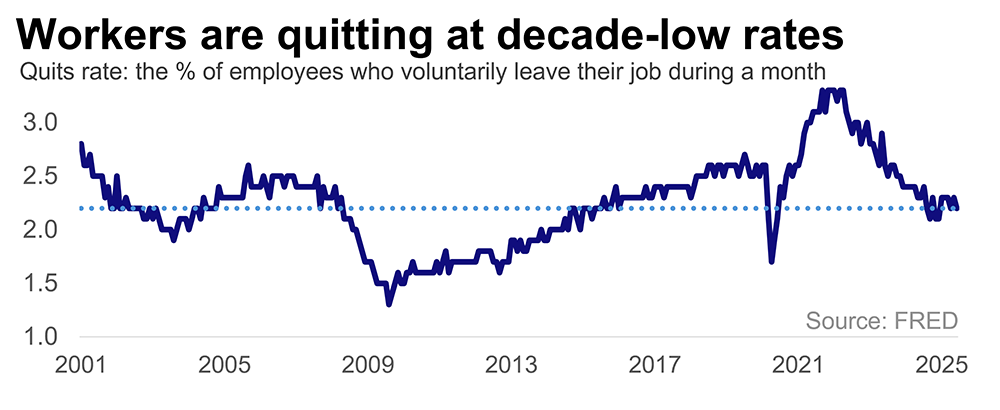

Following a period of elevated job-hopping, workers are now quitting at the lowest (non-Covid) rate in a decade (see: “job hugging”). Interestingly, layoffs are also quite low, reflecting a growing belief that it's cheaper to retain staff through economic tumult than to hire and train new workers once conditions improve. And while a low firing rate may prevent recession, a lack of labor market dynamism will weigh on growth over time.

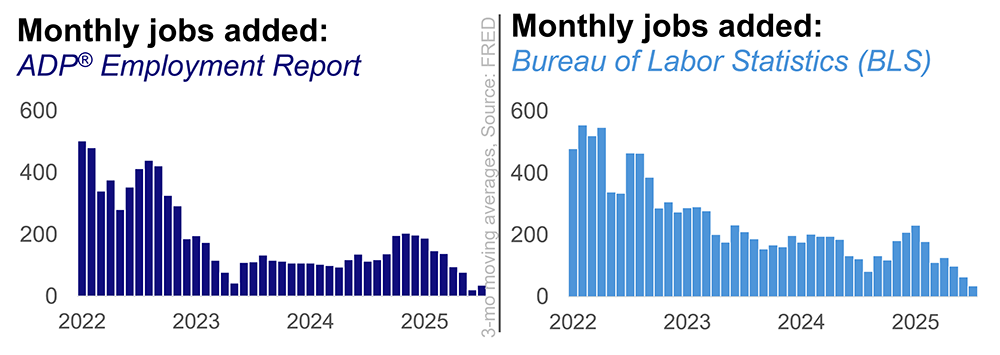

The Bureau of Labor Statistics (BLS) received unwanted attention this summer when its July jobs report featured a big downward revision to prior growth estimates, prompting the president to fire the bureau’s commissioner. And while such a large adjustment does beg the question of whether the data collection could be improved (it could), the closeness with which the government data tracks the private data (i.e., ADP) suggests an unlikelihood that anything more sinister was afoot.

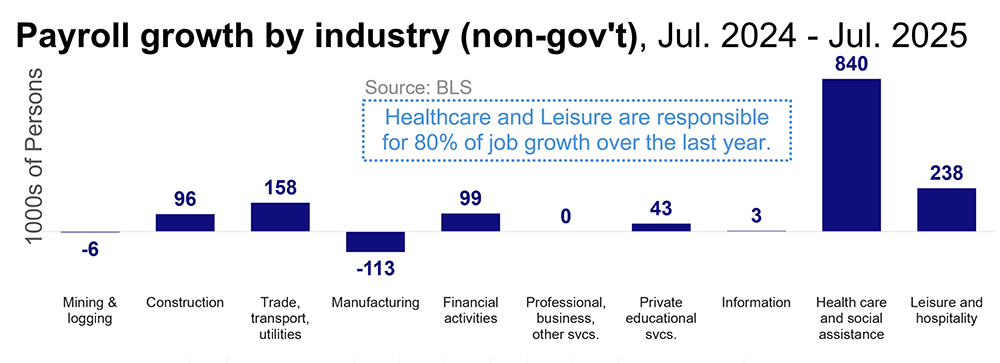

Much like the stock market’s concentration in a handful of big stocks, job additions have been concentrated in a few high growth sectors: Healthcare, buoyed by an aging population and less cyclical demand profile, and Leisure, fueled by healthy consumer balance sheets and the ongoing post-Covid “experiences” boom. Weakness in both information and manufacturing, on the other hand, bears watching given both sectors’ proximity to key themes (A.I., U.S. reindustrialization).

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.