Key Takeaways from Strategas Research Areas

Strategas provides a comprehensive snapshot of current market and economic conditions through their eight research areas

February 24, 2026

Investment Strategy

Jason Trennert, Chairman, Chief Investment Strategist

Employment, financial conditions and profits all tilt toward a continuation of the current bull market. The market looks expensive by most metrics but corporate profits have been strong and the growth outlook is healthy.

- Signs of a bull market. Initial claims for unemployment continue in the ~220k range, 10-year Treasury yields remain below 4.5% (a level at which the market has struggled before), and corporate profit growth rates are in double-digits.

- Market looks expensive. Trailing price/earnings, forward price/earnings, enterprise value/sales, price/book, price/sales are all elevated, but valuation is a poor timing tool and corporate profits remain strong.

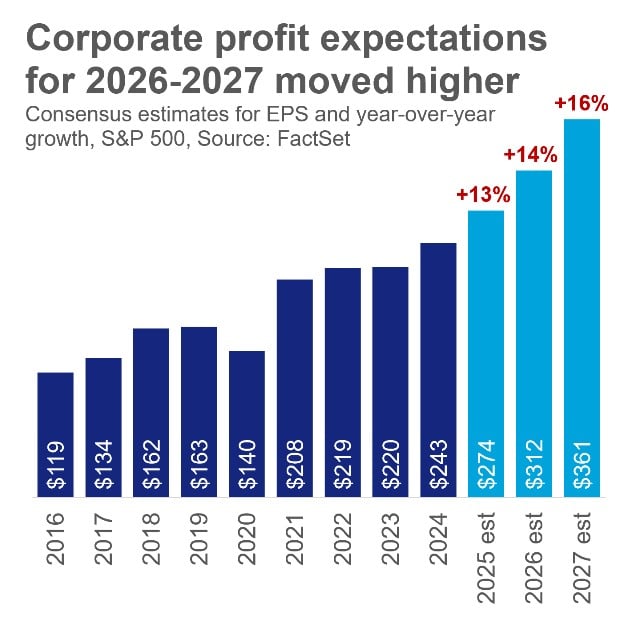

- Corporate profits strong. Elevated valuation multiples have been digested by strong corporate profits: for 4Q25, S&P 500 earnings per share were up +13.5% year over year (with revenue at +8% y/y for a second quarter in a row). It is unusual for the economy to get into too much trouble when earnings are growing at roughly twice the rate of GDP.

- Expanding margins. Expected operating margins have expanded to more than 19%, with Technology a major contributor. If AI infrastructure buildout is truly bringing productivity gains, we would expect operating margins for the equal-weighted S&P 500 index to reach new highs (which has yet to be seen).

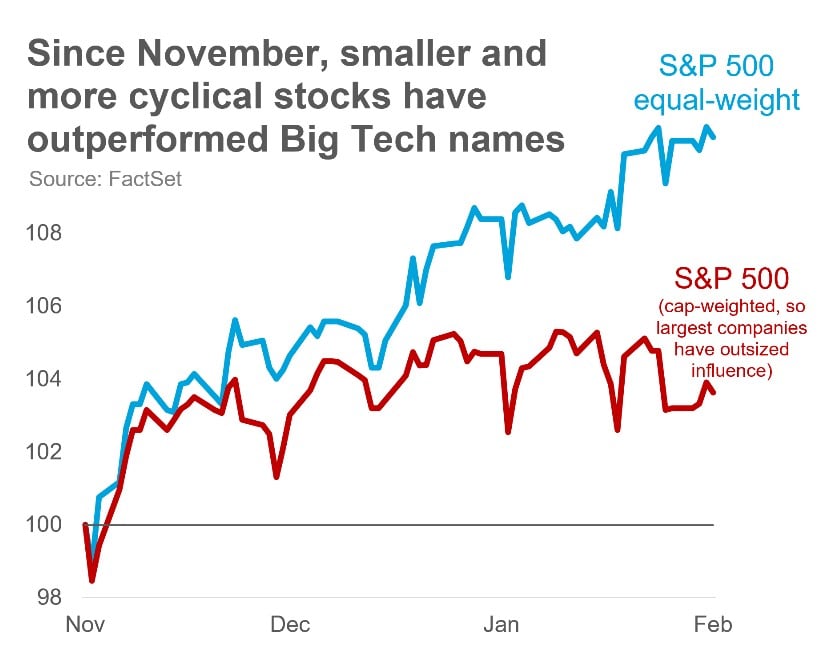

- Cyclicals favored. The One Big Beautiful Bill and prospects for monetary and regulatory easing in 2026 are likely to make the economy look like something approaching an economic recovery. This is why we favor cyclical sectors like Financials and Industrials, the equal-weighted S&P 500 vs. the cap-weighted S&P 500, and small-caps over large-caps.

- Healthy growth outlook. Consensus growth estimates were revised above an already healthy outlook to +7% y/y (revenue) and +14% y/y (profit). We see positive follow-through from corporate activity, albeit slightly below what consensus calls for. We estimate S&P 500 operating EPS of $285-290 (+9% y/y) this year vs. the consensus estimate of $312 (+14% y/y).

- Investment themes. Our major investment themes remain 1) Cash Flow Aristocrats; 2) Artificial Intelligence; 3) the Industrial Power Renaissance; 4) Deglobalization; and 5) a 2026 Consumption Wave.

Washington Policy

Dan Clifton, Head of Policy Research

Ahead of the midterms, the Trump administration is focused on gaining leverage over China, running the economy hot, and affordability.

- Urgency on China. Ahead of an April meeting with Xi Jinping, President Trump is trying to gain leverage over China by consolidating the Western Hemisphere and rooting out China’s proxies in Venezuela, Cuba, and Iran. This seems to be driving up the cost of China’s global adventurism while restoring U.S. growth and reordering the trade system to U.S. strengths. China has leverage via rare earths, which is the reason for the administration’s interest in Greenland.

- Running hot. Midterm election years are often better for the economy than for stocks. Trump is ready to run the economy hot with over $650B of stimulus set to deploy in 2026: 1) $340B from a still-expanding Fed balance sheet; 2) $220B of net fiscal policy benefit as consumers and businesses benefit from OBBB despite higher capital gains revenue; 3) $200B estimated from mortgage-backed security purchases; and 4) $110B from tariffs.

- Financial deregulation. Kevin Warsh’s nomination for Fed chair has drawn attention to how he would handle the Fed balance sheet. We think Warsh knows he can’t cut the balance sheet without hurting the Treasury market. We expect rate cuts followed by financial deregulation and then balance sheet reductions. The goal is to make it easier for the banks to hold Treasurys, increasing demand, and avoiding financial conditions tightening as the Fed balance sheet shrinks.

- Dems in the driver’s seat. Democrats have outperformed in 46 of 55 special elections since January 2025, which would translate to Republicans losing 27 House seats in the midterms (Democrats need 3 to take control). Some Republican-held Senate seats could also be in play. The Trump administration knows the stakes are high and is focused on running the economy hot and pushing for changes around stock sales by Congress members and health care affordability as election messages for the midterms. Efforts to redistrict the House are turning into a wash

Economics

Don Rissmiller, Chief Economist

We place the odds of a recession in 2026 at just 20% (with a 60% odds of solid growth and a 20% chance of upside surprise).

- Growth. Recent U.S. data have already shown rolling weakness in housing and manufacturing. Tariffs have also been a restraint, but there is significant fiscal stimulus for consumers in the pipeline and the AI capex story is a support. We are using a 20% chance of a U.S. recession in 2026, with 60% odds of solid growth, and 20% upside surprise.

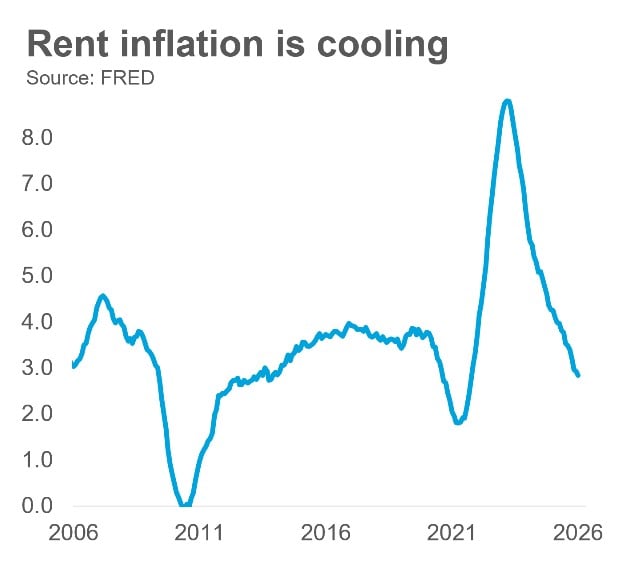

- Inflation. Inflation peaked in 2022 and this wave appears to be over (expectations still look anchored). History suggests that a second wave tends to build (87% of the time globally), but the lull between waves can last several years. Supply chain problems from tariff implementation have not been significant. Domestic rents also remain in a slowing trend.

- Policy. 2024 and 2025 saw lower monetary policy rates, justified first by inflation coming down and reinforced by cracks in the employment situation. The Fed’s goal should be to get monetary policy into a neutral zone, in our opinion. That requires a few more rate cuts, but the Fed does not appear to be in a rush. The lack of government data due to the shutdown may be causing some policymakers to move cautiously.

- Risks. The fiscal supports that allowed prior growth have not been cost-free. The U.S. federal budget deficit remains large and while there’s no emergency, it threatens to crowd out other economic activity (though this does not appear to be happening yet). Fixing this abruptly risks an economic stop. Alternatively, inflation could return if inflation expectations become unanchored due to repeated shocks.

- Hope. Productivity (more output per hour) can conceptually alleviate a second inflation wave. The problem of too much money chasing too few goods can be stymied… by producing more goods. While there is promise on this front from tech advances, we would like to see the profits of both the producers of new technology (e.g., AI) and the users of that technology growing at the same time.

Asset Allocation

Nicholas Bohnsack, President, Head of Portfolio Strategy

Earnings and rates point to continued cyclical growth even as longer-term risks build. Our approach balances participation with prudence in an evolving environment.

- Short- and long-term diverging. In the foreground, the cyclical picture is constructive with earnings and interest rates supporting a global economy emerging from a mid-cycle (late-2025) “soft patch.” The longer view reveals structural tension and a set of fragilities – fiscal expansion, geopolitical friction, funding concentration – that have become intertwined. The issue is not imminent crisis, but cumulative strain. Allocators would be wise to consider these shifting dynamics and the implications for portfolio construction beyond the intermediate-term.

- Adding to alternatives. Over the past several years we slowly increased exposure to Gold and extended precious and industrial metals through the “Alternatives” sleeve in our tactical allocation portfolios. In November we migrated to a 60/30/10 framework of stocks/bonds/alternatives.

- Remaining measured. We think it’s important to participate in cyclical strength but recognize the structural recalibration underway. We recommend maintaining exposure to U.S. stocks, with emphasis on sectors aligned with supply-side investment and pricing power such as Defense, grid modernization, infrastructure, industrial capacity. Be selective with fixed income duration and value liquidity as optionality in an environment where political risk is first-order. Cyclical strength and structural fragility can coexist, but investing requires an evolving playbook.

Technical Strategy

Chris Verrone, Head of Macro And Technical Strategy

The market trend remains positive, but near-term volatility and consolidation risks have increased as leadership rotates away from mega-cap stocks toward cyclical, value-oriented areas.

Base case:

Base case:

- S&P uptrend intact, but Feb. seasonality is soft and consolidation risk is elevated.

- Ongoing global cyclical recovery. We prefer real economy stocks / industries vs. the market’s speculative corners.

- It’s a rotational market. We prefer equal-weight S&P vs. cap-weight, small vs. large, and “rest of world” vs. U.S.

- Yields remain stable with short-term rates near the lows. A curve steepening trade (a widening gap between short-term and long-term rates) has been dominant but this could change.

- Strategic turn for Healthcare while Energy also emerges. Sentiment suggests the bar remains low for both. Tech remains split with less than 50% of sector constituents above their 200-day moving average. Software is oversold, but with weak trends.

- Blowoff top in Silver. Gold in timeout. Copper is the story. Be careful with other parabolic charts.

- Risks to base case: Private capital stocks remain weak, Consumer Discretionary vs. Consumer Staples has softened despite a well-formed narrative around stimulus / tax refunds in 1H26, bitcoin and related assets suggest global liquidity is tightening, currency volatility is higher than usual, new FOMC chairs are often challenged by markets (plus it’s already a midterm year). And further, we just don’t know many bears today – sentiment remains a risk.

- Potential Surprises: the Japanese Nikkei breakout could be structural, bitcoin could continue to drop, housing stocks could turn higher, we could see a 2-year Treasury yield under 3%, and oil could bottom and turn up. The Fed could cut rates more than expected in an already-accelerating economy (asset bubble could still loom), and the market could start to price in a “blue wave” ahead of the midterm elections.

Fixed Income

Tom Tzitzouris, Head of Fixed Income Research

Economic growth may pick up mid-year, which could keep the Fed cautious on rate cuts. Credit conditions may soften near term, but improving growth would help contain spreads.

Rates outlook. We anticipate that today’s mixed economy will transition into one of above-trend growth for the middle third of 2026. This should keep the Fed in a holding pattern for additional rate cuts. Could the Fed ease anyway? Yes. But even if there’s room to ease in 2026, it’s likely dependent on inflation continuing to decline. The market is pricing in 2+ cuts for the remainder of this year, though we would lean towards 1, or even no more cuts for this year. We would also lean towards 10-year yields making their way back out to and above the 4.50% level that held, on average, for much of the last 2 years. Short-term yields could be slower to move higher, but we anticipate that rate hike talk will pick up, with the market pricing the next hike in for mid to late 2027.

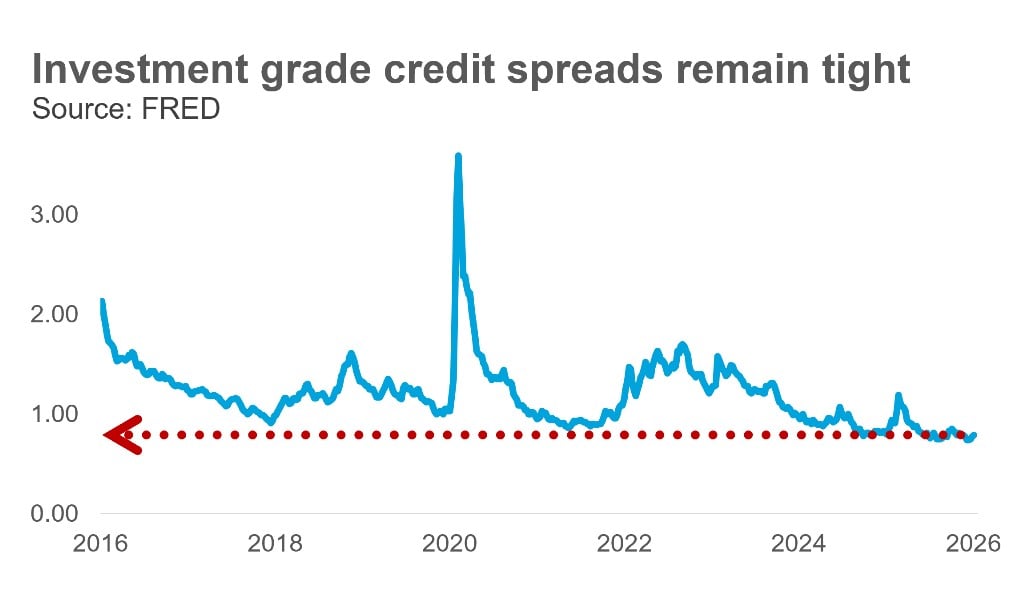

Rates outlook. We anticipate that today’s mixed economy will transition into one of above-trend growth for the middle third of 2026. This should keep the Fed in a holding pattern for additional rate cuts. Could the Fed ease anyway? Yes. But even if there’s room to ease in 2026, it’s likely dependent on inflation continuing to decline. The market is pricing in 2+ cuts for the remainder of this year, though we would lean towards 1, or even no more cuts for this year. We would also lean towards 10-year yields making their way back out to and above the 4.50% level that held, on average, for much of the last 2 years. Short-term yields could be slower to move higher, but we anticipate that rate hike talk will pick up, with the market pricing the next hike in for mid to late 2027.- Credit Spreads. Consistent with the stop and go economy over the next year, we expect to see credit spreads wobble slightly higher between now and mid-2026, though we expect a growth pickup in the middle third of 2026 (along with one more rate cut) to keep the lid on credit spreads until the end of 2026. But we anticipate that as growth begins to slow late this year, and rate hikes become more likely than additional cuts in 2027, that lid will be lifted and credit spreads will begin a late cycle march higher, with IG spreads reaching above 100 bps, and likely above the 120 ceiling hit during the early-April tariff-related selloff, with high yield spreads pushing above 400 bps again.

Equity Derivatives

Brandon Kobelt, Head of Equity Derivatives Research

Overall index volatility has remained contained but single-stock volatility is elevated, leaving markets vulnerable to periodic tests amid ongoing geopolitical risks.

- Breadth. Market broadening and rotation continue in the beginning of 2026, as the environment is characterized by a move away from the Magnificent 7 toward more cyclical sectors. This is best seen in the notable underperformance of the S&P 500 relative to the S&P 500 equal-weight. While essentially flat as a group in January, the Mag. 7 cohort is having a tougher February, pulling broad large-cap indices lower.

- Dispersion. There is significant dispersion under the surface. While the S&P 500 index is relatively flat year-to-date, more concentrated sectors and single stocks have experienced violent moves. Software is down -20%+ YTD, while Energy is up 20%+, with Materials (+16%), Homebuilders (+16%), and Semiconductors (+13%) close behind.

- Vol. So far, volatility has been contained in the S&P 500, with the index rangebound within a stone’s throw of all-time highs. But while options dealers’ hedging activity has helped keep volatility muted at the index level, it has exacerbated volatility at the single-stock level. So far, a true shock has failed to materialize (the short-lived threat of additional tariffs on Europe in January was the closest we came, and that faded quickly), but given the abundance of geopolitical risks, the S&P 500 is likely to be tested again several times this year, potentially soon.

ETF Research

Todd Sohn, Chief ETF Strategist

Strong ETF inflows reflect continued confidence in the market. Leadership is diversifying, which is good to see. Declining money market yields may spur rotation into more active strategies.

- Enthusiasm. Tactical ETF flows (i.e. trailing 3-months) remain in their upper boundary, reflecting a very enthusiastic market. We’re also cognizant of the structural move of assets into the ETF investment vehicle, with back-to-back trillion-dollar inflow years.

- Breadth. Importantly, sector flows are broadening out from a purely Tech- and Growth-focused approach. Industrial, Healthcare, and Energy sector flows have accelerated, with the latter two coming out of multi-year washouts. We’d color this a near-term risk but believe there is substantial room for normalization. Small-caps fit into a similar bucket…a tactical chase, but 2025 was the rare year where the entire small-cap universe posted annual outflows.

- Risks and opportunities. Leverage does remain a concern with our levered asset ratio at +11:1. New levered single stock funds continue to populate, many of which are going down the capitalization scale and up the volatility scale. Money market funds are home to nearly $8 trillion AUM but with yields dripping lower; we believe there is opportunity for a broader rotation into active management and higher yielding assets. We’d also focus attention on strategies that are less correlated to the market and thematic diversification across the product spectrum.

IMPORTANT DISCLOSURES

Investors should consider the investment objectives, risks, charges and expenses of any fund carefully before investing. This and other information about a fund can be found in the prospectus or summary prospectus. A prospectus or summary prospectus may be obtained from your financial advisor or the fund website and should be read carefully before investing.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index. Market and economic statistics, unless otherwise cited, are from data providers FactSet and Bloomberg.

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

Baird does not currently recommend the purchase of any cryptocurrencies, products that attempt to track cryptocurrencies, or cryptocurrency custodians. Baird does not custody Bitcoin or any other cryptocurrencies.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at https://researchdisclosures.rwbaird.com/. You can also call 1- 800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.