A Deeper Look at the National Debt

Strategas Chief Economist Don Rissmiller discusses in-depth the issues he’s watching on the budget deficit and national debt: the key indicators and constraints, the reasons for optimism, and when might the debt could become an issue for investors.

Ross Mayfield: What are some of the key constraints or issues we should be aware of when thinking about the national debt?

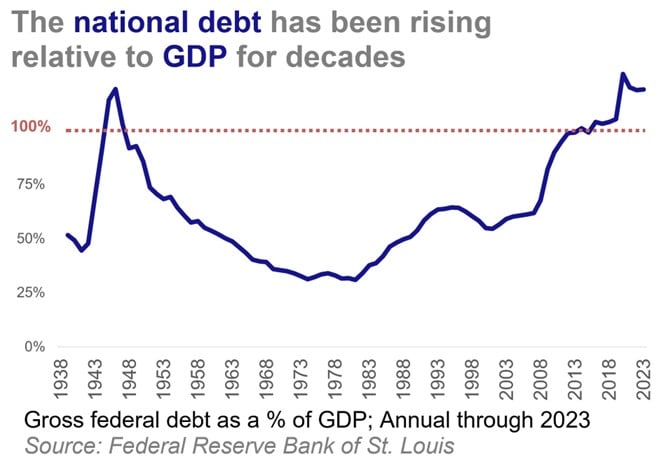

Don Rissmiller: Countries get in big trouble when they have sovereign debt that's 1) not issued in their home currency; and/or 2) owned by foreigners. Those conditions don't apply universally to the U.S. because our debt is denominated in U.S. dollars. Now we do have debt that's owned abroad, so there is some reason for concern, but whether that concern is an emergency or not will be the conversation over the coming months as we work through the tax bill, the debt ceiling, etc. And the budget constraint I would give you is that debt relative to income/GDP has to go sideways over a long period of time. If you have your debt relative to income going up indefinitely, there will come a point when interest costs consume your entire budget. You don't want that. So, the budget constraint we're trying to satisfy is to get that debt-to-GDP ratio to flatten out.

Don Rissmiller: Countries get in big trouble when they have sovereign debt that's 1) not issued in their home currency; and/or 2) owned by foreigners. Those conditions don't apply universally to the U.S. because our debt is denominated in U.S. dollars. Now we do have debt that's owned abroad, so there is some reason for concern, but whether that concern is an emergency or not will be the conversation over the coming months as we work through the tax bill, the debt ceiling, etc. And the budget constraint I would give you is that debt relative to income/GDP has to go sideways over a long period of time. If you have your debt relative to income going up indefinitely, there will come a point when interest costs consume your entire budget. You don't want that. So, the budget constraint we're trying to satisfy is to get that debt-to-GDP ratio to flatten out.

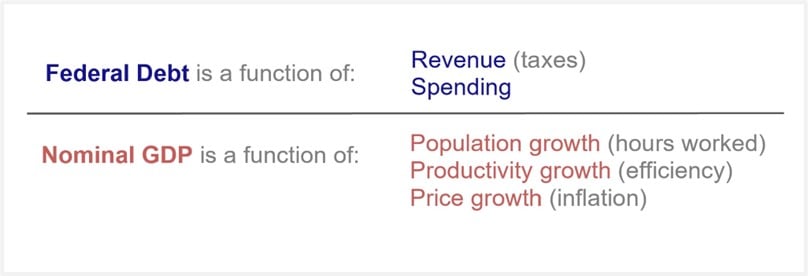

What are the ways to do that? Let’s first look at the numerator of that equation: the annual deficit and overall debt are really a function of taxes and spending. And pretty simply, in terms of the deficit reduction, I don't see a lot right now that's going to make a big difference on those fronts in the medium term (i.e., higher taxes or less spending). So that pushes us into the denominator – growing nominal GDP faster than the debt. We would break nominal GDP into inflation and real GDP (which we’d break down further into “hours worked,” or some population growth variable, and “output per hour,” our productivity proxy). Looking at current immigration policy and demographics, I would not bank on population growth as our economic driver. So, we've crossed off taxes, spending, and population growth as things that are going to help in the medium term.

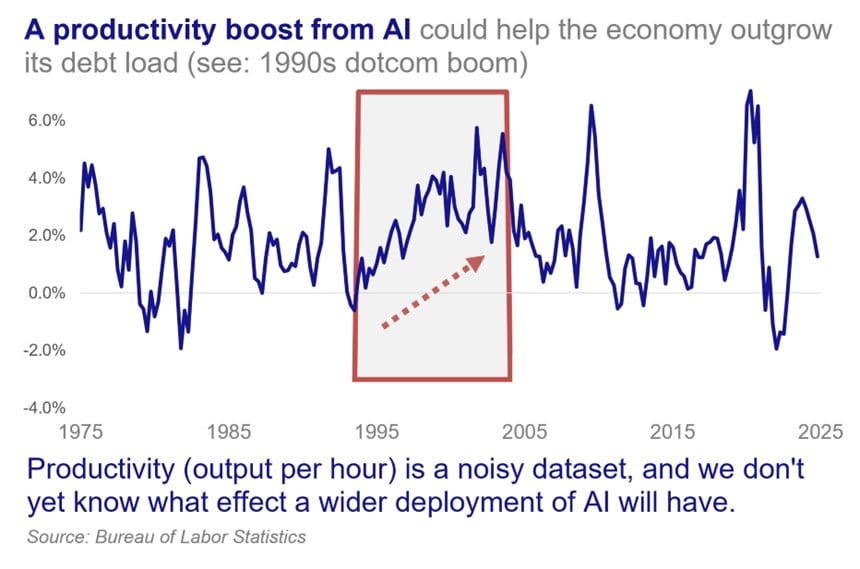

That leaves inflation and productivity. And I think that's how we're going to have to judge the next several years. It's going to be a race between those two. If we have an expanding deficit and expanding debt-to-GDP ratio, the risk is that we're going to see a return of inflation. I don't think this is immediate. I think there are things that can be done in the short run to help with that. But the big hope is that the private sector can help bail out the public sector here by improving worker productivity so that the country produces more goods with similar (or smaller) inputs. If we can get a productivity-driven growth boom, then debt-to-GDP can start to flatline a bit. That's the budget constraint we're trying to satisfy so that the concern does not become an emergency down the road.

Ross Mayfield: Can you talk about the importance of the US national debt being denominated in dollars? And then, if the constraint isn’t our ability to provide the actual payment on our debt, what might it be?

Don Rissmiller: The good news is that U.S. national debt is denominated in a currency that we can print. And that’s not always the case (think about economies abroad that issue debt in dollars – as emerging market countries often do ‒ or an economy abroad that's part of a currency union and doesn’t control the printing press, such as Greece post-2008). But because we issue debt in our own currency, we can always pay the dollars that the debt demands. What we can't guarantee is what those dollars buy. And so, the relief valve will come down to what the longer-term inflationary picture looks like. I don't think it'll be a crisis or a failed auction. It would be those dollars that you get as an interest payment start to buying less and less over time.

Ross Mayfield: If population growth won’t fuel future economic growth, what are the prospects for a sustained productivity boom in the U.S.? Are you seeing evidence of that yet? And what should we be watching to see if that's a story that's starting to play out?

Ross Mayfield: If population growth won’t fuel future economic growth, what are the prospects for a sustained productivity boom in the U.S.? Are you seeing evidence of that yet? And what should we be watching to see if that's a story that's starting to play out?

Don Rissmiller: This is critically important because it doesn't look like we're going to get a big expansion of hours if we're trying to combine hours worked and output per hour to approximate overall economic growth. So, it comes down to output per hour ‒ the productivity variable. Said another way, what we're trying to achieve is instead of having too much money chasing too few goods (i.e., inflation), we want to be able to produce more goods to balance that equation…take the factors of production we have and get more out of them (that's also the way to cut off any second wave of inflation at the knees).

And all of this requires some of the productivity stories that we know about ‒ whether it's AI or other technologies ‒ to make workers more efficient.

What I want to see is confirmation that both the producers of the technology and the users of the technology are growing profits at the same time. I think that's the missing element right now. We know the producers of some of the technology have seen profits expand (e.g., semiconductor producers, data center manufacturers). But we need non-tech companies to report earnings and say, “my profits are up because I have access to this new technology.” That’s what I need to see to believe that AI is a viable path to getting that debt-to-GDP ratio back to a sustainable place.

Ross Mayfield: Let’s end here: when does this become an issue for investors, and what should we be watching to get a sense of that?

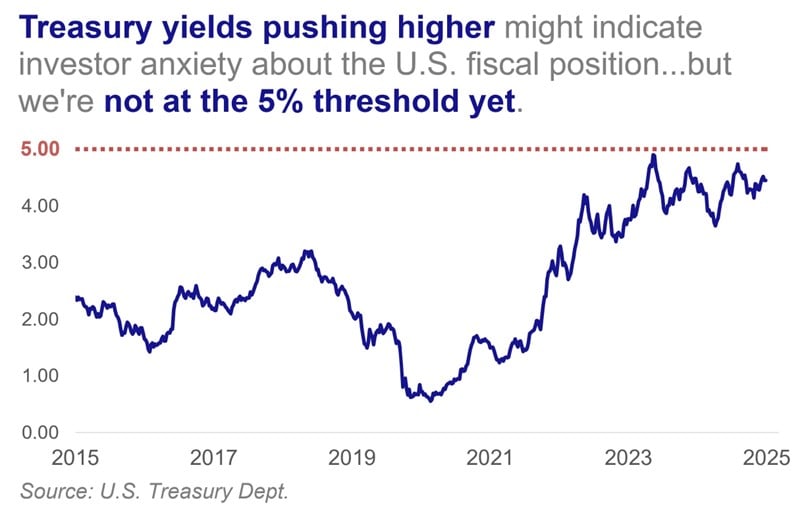

Don Rissmiller: It likely would show up as rising long-term bond yields (in the past, “bond vigilante” investors would sell government bonds as condemnation of inflationary/irresponsible fiscal policies; bond yields rise as prices fall). Let's say we saw the 10-year Treasury rise toward and potentially push through a 5.00% yield. I think that would start to spook investors (remember that higher bond yields raise borrowing costs, reduce corporate profitability, and generally weigh on stock valuations). And then the government reaction to that would be key. We have tools to manage bond market moves like that (e.g., Treasury buybacks, tweaking rules to allow banks to buy more Treasurys). But if we run out of tools, and yields keep drifting higher, that would start to be a problem. I don't think we're there yet, but let's keep monitoring that.

Don Rissmiller: It likely would show up as rising long-term bond yields (in the past, “bond vigilante” investors would sell government bonds as condemnation of inflationary/irresponsible fiscal policies; bond yields rise as prices fall). Let's say we saw the 10-year Treasury rise toward and potentially push through a 5.00% yield. I think that would start to spook investors (remember that higher bond yields raise borrowing costs, reduce corporate profitability, and generally weigh on stock valuations). And then the government reaction to that would be key. We have tools to manage bond market moves like that (e.g., Treasury buybacks, tweaking rules to allow banks to buy more Treasurys). But if we run out of tools, and yields keep drifting higher, that would start to be a problem. I don't think we're there yet, but let's keep monitoring that.

The other thing to watch would be other countries with even higher debt-to-GDP ratios, like Japan. Could we start to see some reaction there first? If this is going to be a problem in the U.S., we can monitor what's going on elsewhere to see how significant an issue this becomes.

This conversation is lightly edited and consolidated from an interview located at www.youtube.com/@BairdTV.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index. Market and economic statistics, unless otherwise cited, are from data providers FactSet and Bloomberg.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security.

Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies.

Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/third-party-research-disclosures.aspx. You can also call 1- 800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.