Deeper Corrections but Stronger Recoveries in Midterm Years

With market volatility picking up and a midterm election on the horizon, the Policy Team at Strategas gives some insight into how midterm years typically play out, why they tend to be more volatile than average, and what the longer-term picture looks like.

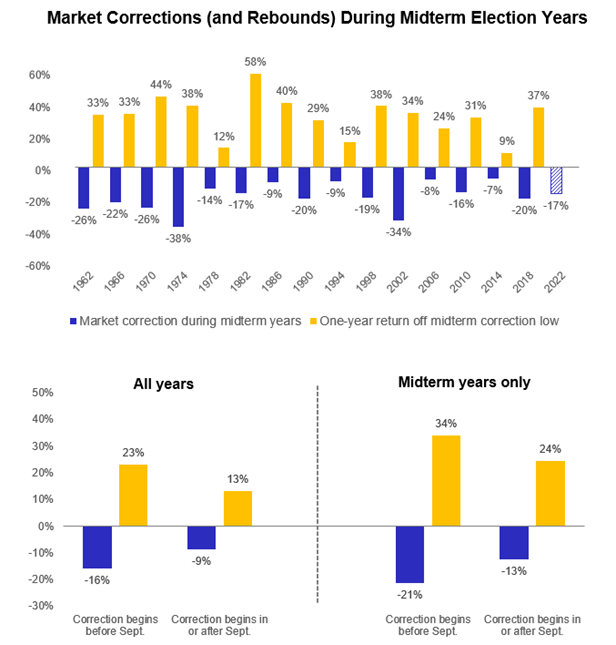

Midterm election years are historically the most volatile of the four-year presidential cycle for the stock market.

The average S&P 500 intra-year decline in midterm election years is 19%, compared to just 13% in the other three years of the presidential cycle. We have generally found midterm election years to be marked by declining presidential approval ratings, tighter monetary policy, tighter fiscal policy, and an increasing likelihood of a change in political party.

The past three first-term midterm election corrections (2002, 2010, and 2018) have been quite painful, and 2022 is proving no different. However, the timing of the equity market decline this year has been faster than usual and the scope of the decline has been deeper than usual. This is largely due to higher inflation and heightened geopolitical risk on top of other factors. Interestingly, the S&P 500 has been trending very similarly to its 1982 pattern, the last time we were dealing with high inflation, Russia, and a midterm election all at once.

The past three first-term midterm election corrections (2002, 2010, and 2018) have been quite painful, and 2022 is proving no different. However, the timing of the equity market decline this year has been faster than usual and the scope of the decline has been deeper than usual. This is largely due to higher inflation and heightened geopolitical risk on top of other factors. Interestingly, the S&P 500 has been trending very similarly to its 1982 pattern, the last time we were dealing with high inflation, Russia, and a midterm election all at once.

However, we have generally found that just getting to the midterm election has been a positive catalyst for stocks, regardless of which party wins the election. The S&P 500 has not declined in the 12 months following a midterm election since 1946, and the S&P 500 has been up by an average of 32% one year out from the midterm year bottom. As the chart on the right shows, the earlier the decline occurs in the midterm election year, the stronger the recovery. With the midterm election fast approaching and with volatility heightened, the policy team at Strategas will stay vigilant.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.