You May Be Wealthier Than You Think

Melanie Schmieding, CTFA, Director of Baird Family Wealth

Melanie Schmieding, CTFA, Director of Baird Family Wealth

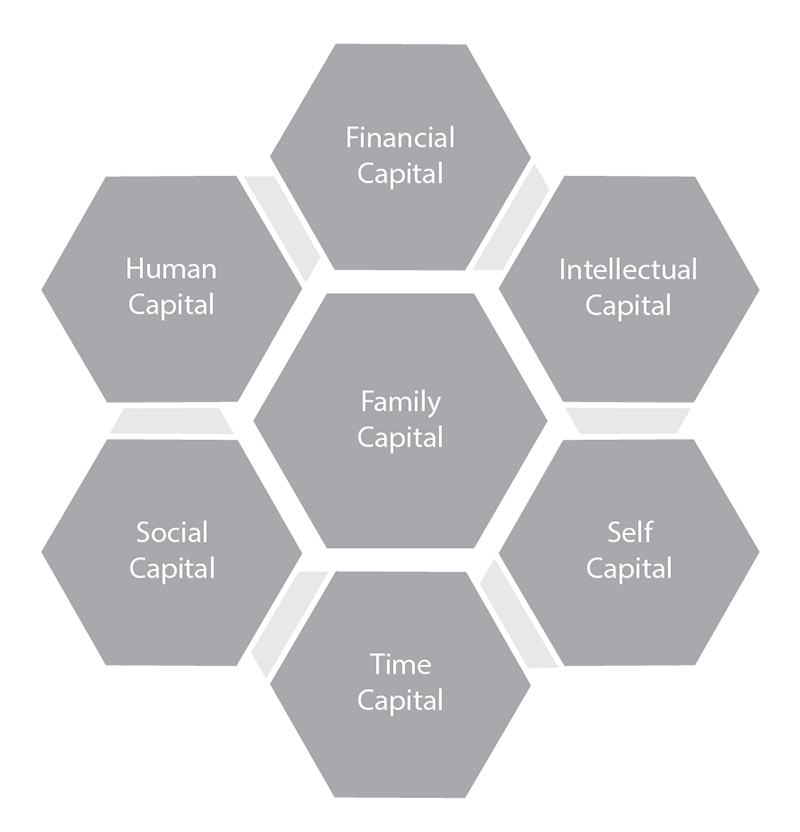

When thinking about the capital used to build a legacy, most people immediately default to their hard assets – the financial wealth they’ve accumulated over time. But the gifts and resources your family passes through the generations expand far beyond money. Let’s explore the various kinds of family capital you already possess and what you can do to develop them.

“If we want to empower our families’ future stewards of wealth, we can start by applying a more holistic and fundamental definition of what ‘wealth’ really is.”

Defining Your Family’s Capital

Enhancing your family’s capital takes time and intentionality, and it starts with understanding all the assets your family already possesses.

Financial capital can be considered your “hard assets” – cash, stocks, bonds, real estate. It’s the most readily understood component of family capital.

Your financial capital is arguably the easiest to quantify and transfer to others, be they members of your own family or outside charitable organizations. As you consider your financial capital, it’s worth asking:

- For what goals will family capital be put to use? What do you want your family capital to accomplish over the long term?

- Are other family members fully involved in the design and goals of your wealth management plans? It’s not uncommon for individual family members, especially those of younger generations, to have life goals and priorities that are different from your own.

- Is your financial capital appropriately structured and invested to accommodate, if not thrive in, a range of market conditions?

Intellectual capital is the “hard skills” family members need to have to be contributing members of society. It includes the knowledge the family has accumulated over time, such as a family member’s college degree, the understanding how to run a family business or hard-earned perspectives from life experience.

Often intellectual capital runs hand-in-hand with financial capital, such as when financial wealth is accumulated through a family business. Here are some questions to consider as you look to your own family’s intellectual capital:

- Does your family’s intellectual capital need to be shared? If important knowledge is consolidated in just one or two people, you should consider a plan for passing it on for the future.

- How will you develop your intellectual capital? This is especially relevant for family businesses: As society evolves, so do its technology and the needs of its citizens, and what brought your family business success doesn't guarantee its future. If your family’s intellectual capital is to stay relevant, it needs to keep pace.

- Intellectual capital is not just for family businesses: Every family has a history – how it came to be, the obstacles it has overcome. This important information can be lost without concrete plans to pass it on to future generations.

Human capital comprises the “soft skills” family members need to have to build relationships and develop personally. It includes the ability to mature and learn how to self-manage.

We all know people who seem emotionally older or younger than their physical age would suggest – and there are times in every family where human capital is essential. Consider:

- Families often burn through financial wealth when it’s transferred to members who lack the human capital to serve as good stewards. Have you taught your children how to prepare for inheriting wealth or considered placing conditions on when and to whom that wealth is transferred?

- How can you further the human capital of the next generation? A college education can be a worthwhile investment, but only if the recipient is mature enough to take advantage of the opportunity.

- For those moments when maturity and judgment are particularly indispensable, such as a health emergency requiring power of attorney or healthcare power of attorney, do you have a plan in place so the right person is making important family decisions?

Self capital can be thought of as the routines and rituals that ground individuals and families – the traditions that reaffirm each family’s values and bring us closer together.

Self capital is what makes a family a family – the in-jokes, the shared experiences, the values and behaviors we pass down, the understandings and memories we cherish for a lifetime. In many families, it’s the reason we accumulate financial wealth in the first place. So how can you develop your own family’s self capital?

- What make up your family’s self capital rituals? If you regularly schedule family meetings, this could be something the family can discuss.

- How do you balance financial capital against self capital? Building up financial wealth is often needed to meet your long-term goals, but not at the expense of strengthening your own family’s bonds.

- Self capital is as much about the future as the past. Can you start a new family tradition (a family vacation, a second property for people to visit) that can be built into your wealth management plans?

Social capital is your family name, reputation or presence in the community. Unlike the previous aspects of family capital, social capital creates its value outside the family structure.

For families who are especially active in their communities, social capital is a vital component of family capital and legacy planning. Here are questions to consider as you build your family’s social capital:

- What is your family known for? What is your reputation in the community?

- What can you do to develop your social capital? Are there philanthropic activities or creative business or charitable sponsorships that can bolster your financial capital as well as your social capital?

- Are there ways to tie efforts to build your social capital with your intellectual or self capital? For example, if you choose to fund a charitable foundation, how can you do so in a way that makes sense and is personal to your family?

Time capital reflects your most precious resource – how much time you have on Earth. And as we might also say about your financial capital, its value is determined less by how much you have and more by what you do with it.

Time capital is a resource, and like any resource, it needs to be spent wisely. As you think about how you use your time, consider:

- How well are spending your time? Often we’ll see the head of a family working to increase their family’s financial capital – not because the work gives them purpose or their wealth management plans demand it, but out of habit. Would that time be better spent on your family’s self capital?

- You can’t buy more time capital, but maybe you can outsource it. Are there tasks that can be delegated elsewhere to free up your time?

- Time capital applies to more than just you. Are there ways to increase the time capital for other family members?

A Fuller Understanding of Wealth

This more holistic understanding of family capital can influence a range of family behaviors and dynamics, from fostering a sense of stewardship to talking about wealth to kids and grandkids. It can also offer a new, broader perspective into wealth management and the services offered through your Baird Financial Advisor, helping you develop the multiple aspects of family capital and increase your own family’s wealth.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.