Retirement Guide

for Women

Understanding Your Wealth: Expenses

Of the four components to your financial picture, your spending is likely the one you have the most control over. Success or failure in this category isn’t determined by outside forces like interest rates or market performance: Your spending is entirely up to you, and the decisions you make in this category directly affect the other three.

Spending in retirement can be broken down largely into four discrete categories: living expenses (including housing), transportation, healthcare, and food and entertainment.

Living Expenses

These expenses comprise spending related to housing, like a mortgage, property taxes, insurance, utilities and repairs. It also includes regular maintenance – something a lot of retirees and pre-retirees overlook. If you plan on staying in your house for 20 or 30 years in retirement, for example, you need to plan for big-ticket expenses like replacing the roof and swapping out appliances. A good rule of thumb is to anticipate spending 1% of your home’s total value on repairs each year, or more if you have an older property.

Transportation

For many people, the early years of retirement are characterized by lots of travel, either visiting family or just vacationing. If that sounds appealing to you, be sure to plan on budgeting for transportation. That includes not only automobiles (which, like the roof, you might need to replace multiple times) and maintenance, but also gasoline, insurance and airfare.

When mapping out expenses, it might be helpful to remember that different phases of retirement have different financial needs. According to reporting by SoFi, people aged 65 to 74 spend nearly $8,500 per year on transportation on average, compared to roughly $5,000 per year for people 75 and older.25 As you make your own retirement plans, consider what travel you’ll like to do, but also where you’d like to live when you are less interested or able to make long trips in the car.

Healthcare

Healthcare is one of the few areas where retirees outspend the national average. Whether it’s due to chronic disease like arthritis or Alzheimer’s, injuries from falling or just the body wearing down, retirees should expect to spend more on healthcare than they have at any other time in their lives. A recent study on costs in retirement found that 85-year-olds spend $39,000 per year on healthcare – roughly three times what 65- to 74-year-olds will spend, on average. 26

One way to combat the high price of healthcare in retirement is through lifestyle choices. For example, one 2023 study found that smokers suffered monetary losses of $59,000 to $108,000 per year when factoring in such expenses as the cost of cigarettes, insurance premiums, healthcare costs and investment opportunity costs.27 A 2020 Lancet study reported that among 84 modifiable risk factors, high body mass index and high cholesterol resulted in the greatest healthcare spending among people aged 45 and older.28 Making lifestyle changes before entering retirement can not only create a higher quality of life, but it can also reduce how much you spend on healthcare.

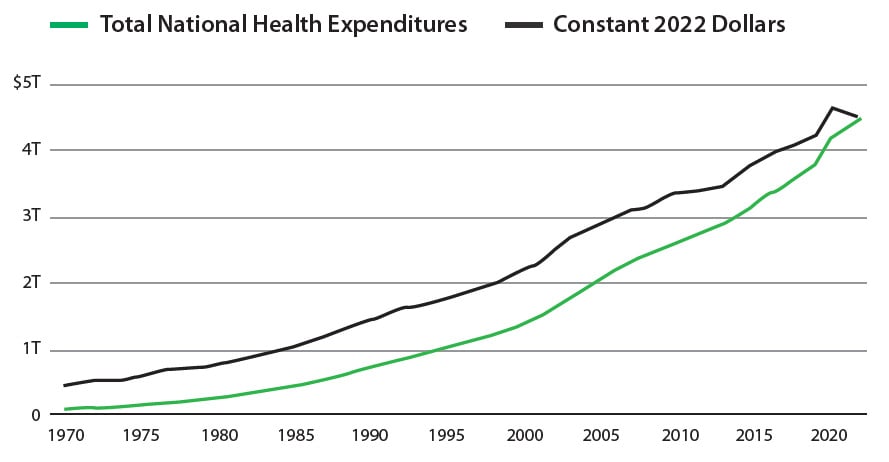

Total National Health Expenditures, U.S. $Billions, 1970-2022

Healthcare costs have risen steadily over the past 50 years.

Source: KFF analysis of National Health Expenditure (NHE) data. 29

There are also financial steps you can take to help mitigate the high costs of healthcare. We previously mentioned health savings accounts, which offer tax-advantaged savings specifically for healthcare expenses. Long-term care insurance can also reduce your healthcare spending in retirement. This kind of insurance is intended to cover the costs of care when you develop a chronic medical condition, disability or disorder, including hospice or respite care, residential care facilities and home-based care. However, you can’t purchase a policy only when you need assistance: Chances are you won’t qualify for long-term care insurance if you already have a debilitating condition. Most people with long-term care insurance buy it in their mid-50s to mid-60s.

Food and Entertainment

Food and entertainment expenses include activities like eating in or dining out, going to museums or the movies, and hobbies. Just as with transportation, expenses in this category tend to decrease through retirement over time. According to SoFi data, people aged 65 to 74 spend nearly $7,000 per year on food and more than $3,000 per year on entertainment. By comparison, those over age 75 spend roughly $5,200 and less than $1,800 annually on food and entertainment, respectively, presumably as interest in and ease of driving or flying diminishes.25 While these are only national averages, they’re a good starting point as you consider your own plans.

How Spending Evolves in Retirement

When we think about retirement, it’s often as if our golden years are one unchanging block of time. The truth is, your lifestyle when you first enter retirement will likely be vastly different than in your later years. This discrepancy is also reflected in retirees’ spending: According to SoFi, retirees aged 65 to 74 spend roughly $54,000 per year, while those aged 75 and older spend less than $42,000 annually, on average.25

As retirees’ needs change throughout retirement, so does their spending.

Baird's Retirement Guide for Women:

NEXT: Where We Go From Here >>

Explore the Rest of the Guide:

Build Confidence in Retirement >>

How We Got Here >>

Understanding Your Wealth: Assets >>

Understanding Your Wealth: Income >>

Understanding Your Wealth: Liabilities >>

Understanding Your Wealth: Expenses

Where We Go from Here >>