In the Markets Now: Bubbles

In a world where an unlimited buffet of information exists at our finger tips, In the Markets Now covers the need-to-know in just one two page(s).

Run Your Own Race

Of the 27 world records set at the 2016 Summer Olympics, perhaps none was more impressive than South Africa’s Wayde van Niekerk establishing a new high water mark for the 400 meter run that is unchallenged to this day. His 43.03 second sprint improved Michael Johnson’s 1999 mark by 0.15 seconds (a lifetime in such a short race) and established his country’s only world record in athletics as of writing. But that’s not what made this race so special.

Some short-middle distance track & field races use a “staggered start” that adjusts runners’ starting positions to account for the curvature of the track (i.e., runners in the outer lanes start further ahead to compensate for the fact that those lanes have a larger circumference). But while this makes the physical distance equal, it can impact the race in other ways. Racing from the farthest outside lane, for instance, is considered to be more difficult because starting in front of the competition limits any real visual contact with the other runners. This makes it more difficult to gauge the speed of the field and pace yourself to victory. You are truly forced to run your own race. And this is where van Niekerk set his record.

What’s this got to do with investing? In my opinion, everything. In an environment like the one we’re in now—a technology-driven bull market persistently fueling bubble talk paired with the modern FOMO (fear of missing out) and attention economy—the idea of “running your own race” ascends to a new level of importance. Because while most investment strategy work (rightfully) focuses on managing market volatility and crashes, there can be existential risks to building wealth in rising markets as well. Chasing hot investments during a bull market, especially those of a riskier nature, can lead to just as devastating a financial outcome as selling at bear market lows. Just this decade, speculative bubbles in crypto/NFTs, meme stocks, and SPACs—and the media frenzies that accompanied them—left an abundance of investors much worse for the wear.

Of course, the fear of missing out (FOMO) is in many ways the defining feature of all the major asset bubbles of the last 400 years: something rising in price so precipitously that investors abandon their priors and rush to buy without proper due diligence or consideration of their own plan, risk tolerance, or goals. Economist Robert Shiller (who literally wrote the book on “irrational exuberance” and asset bubbles) created a 7 item checklist to diagnose a market bubble. The irony is that a majority of bubbles are not about markets at all (e.g., lending standards or valuations) but are instead about collective investor psychology: great public excitement about an asset class going up in price, an accompanying media frenzy, stories of people earning a lot of money (causing envy among people who aren’t), and so on. In fact, I’d argue that a fear of missing out is almost inextricably linked to any asset bubble, because one of the primary ways that a garden variety bull market morphs into a bubble is the FOMO and herd behavior that pushes prices well past any rational level.

And that fear of missing out is a bear for investors. Acclaimed financial writer Morgan Housel has gone as far as calling FOMO the worst financial trait one can have, writing “Having no FOMO might be the most important investing skill. Being immune to the siren song of other people’s success—especially when that success is sudden, extreme, and caused by factors outside their control—is so powerful and important that it’s practically impossible to do well over time without it. When strategizing, Dwight Eisenhower used to quote Napoleon, who said a military genius is ‘the man who can do the average thing when everyone else around him is losing his mind.’ Same with money.”

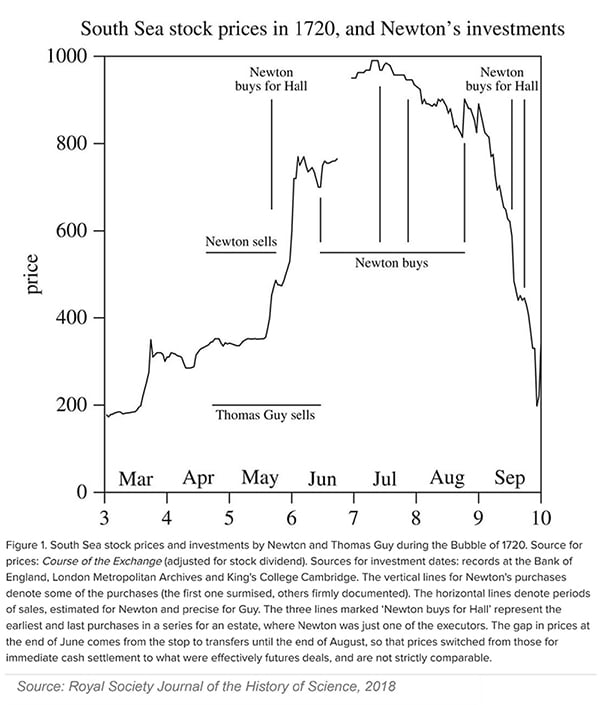

The insidious thing about FOMO is that not even the most intelligent are immune. Sir Isaac Newton, considered one of the smartest people to ever live, absolutely lost his shirt in one of the first asset bubbles in modern history, the South Sea Company in 1720. Jason Zweig wrote about it in an updated version of Benjamin Graham’s The Intelligent Investor. As the story goes, Newton actually dumped his shares early, pocketing a tidy profit, but just months later, “swept up in the wild enthusiasm of the market, Newton jumped back in at a much higher price and lost £20,000 (more than $3 million in today’s money). For the rest of his life, he forbade anyone to speak the words ‘South Sea’ in his presence.” Of course, we are luckier for Newton’s experience because it birthed one of the great quotes about investing, when Newton recapped the bubble by quipping: “I can calculate the movement of stars, but not the madness of men.”

Newton’s experience came long before the 24/7 news cycle and social media complex added kerosene to the already-smoldering human bias toward FOMO. We have far more information at our fingertips today than Newton did, and competition for our attention skews media in a sensational and negative direction. Who knows how much more Newton might have lost if an algorithm was feeding him articles like the 2018 NY Times treatise on crypto, “Everyone Is Getting Hilariously Rich and You’re Not.” Suffice it to say that today’s media environment makes running one’s own race an even more mountainous challenge than in previous eras (Bitcoin and Ethereum fell 75% and 90%, respectively, over the 12 months following the article’s publication). Wayde van Niekerk couldn’t see the other runners when he broke the world record; today’s investors do not have that same luxury.

Now, look, this is not a commentary on today’s markets. I happen to think the current backdrop is not a bubble (at least not yet). Corporate earnings have been strong, AI usage is proliferating rapidly, and sentiment is fairly muted all things considered. But let me be clear—the risk is not that markets will go up a lot and then fall. Markets crash all the time. Sometimes it’s due to geopolitical tension or bad policymaking, sometimes it’s due to an asset bubble popping (famed economist Hyman Minsky even posited that speculative bubbles are an inevitable feature of capitalism, as prolonged periods of economic stability encourage excessive risk-taking, which create the conditions for bubbles to form and eventually burst). As long as humans have a hand in the process, big swings will be a feature of the market, and not a bug. No matter what level of risk tolerance you have, that should be built into your plan.

No, the risk is not that markets will fall. The risk is that the fear of missing out on something bigger, more exciting, and/or more revolutionary will move you toward an investment or a tactic that doesn’t align with your goals or investing strategy. The risk is the allure of charlatans promising high returns for low risk (a bubble staple, by the way: Kindleberger: “it seems clear from the historical record that swindles are a response to the greedy appetite for wealth stimulated by the boom”). The risk is that you end up running someone else’s race. It might seem overly simplistic but remember, your benchmark is not the Nasdaq, or the S&P 500, or (perish the thought) how rich someone else says they’re getting. Your benchmark for your money is your own goals. What is the invested money for? What is the time horizon for when you might need that money? How much of your investment are you willing and able to lose? Is it 20%? What about 100%?

The late Charlie Munger once quipped that, “if a thing is a bad idea, it’s hard to overdo. But where there is a good idea with a core of essential and important truth, you can’t ignore it…the good ideas are a wonderful way to suffer terribly if you overdo them.” Only time will tell if AI is in the stages of becoming a classic asset bubble, Munger’s “taking a good idea and overdoing it.” But if you control what’s within your control and run your own race, the rest will likely fall into place.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.