In the Markets Now: Scattered Thoughts on Gold

In a world where an unlimited buffet of information exists at our finger tips, In the Markets Now covers the need-to-know in just one page.

How should investors think about Gold?

I recently wrote about the power of running your own race and the importance of avoiding FOMO during asset bubbles. I was thinking primarily about tech stocks, the dot-com boom, and other modern investments that tend to inspire fervent speculation (SPACs, crypto, etc.). But as of today, the most applicable asset for this framework is far less modern: Gold. The price of the yellow metal is up 110% in the last two years, and its 40-day return (through Oct. 20) of 29% was the second best move in four decades. Gold is a divisive asset class; some consider it close to the only thing truly worth owning, while others find it more of a shiny pet rock. Unpredictably, I land somewhere in the middle.

Why is Gold booming now?

A huge move like the one we’ve seen lately implies multiple tailwinds and catalysts (including, but not limited to, global central banks buying more than usual, growing fears of a weak dollar and high debt economy, investor enthusiasm sparking price momentum, etc.). Ultimately, commodities like Gold are about supply and demand: global supply growth has been stable and muted in recent years, meaning that demand (primarily from investors) is the main driver of returns.

With Gold, a good story can obscure reality.

Because Gold has no cash flow (e.g., profits, dividends, coupons) and little industrial value, its narrative can be its most powerful driver of returns. Gold has become an outlet for investor concerns such as national debt, currency debasement, and inflation. The problem is that a good story can obscure reality. For example, if Gold’s run is about the national debt, why did it dramatically underperform in the 2010s when national debt concerns were also pervasive? If Gold’s strength is about US dollar weakness, why is it that from Sept. 1985 to 1997, the dollar was down over 25%, US stocks returned 650%, and Gold was flat? Today’s backdrop could be different due to the perceived severity of the catalysts identified above, but it could be that this is just how Gold trades: short-to-medium periods of pronounced outperformance paired with long periods of negative returns. As ever, the four dangerous words in investing are "this time is different."

Gold can be a worthwhile diversifier… but has underperformed.

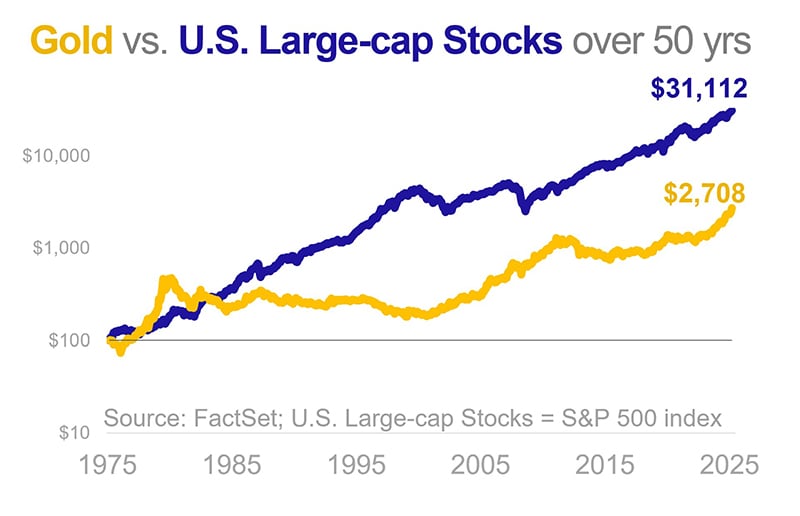

I do believe that Gold’s unique return drivers and long-term track record (5,000 years is a long time) make it a worthwhile holding. It is a useful diversifier for a lot of portfolios, and potentially one with even more value in a deglobalizing, higher debt/inflation world. On the other hand, it has little productive application, no cash flow, and is rarely used as currency. While it has outperformed US stocks at times, it has also seen long periods of negative real returns and has meaningfully underperformed over the last 50 years in total.

Why would Gold grow at an above-average rate over long periods?

For stocks, the answer to that question is capitalism: a profit motive is inherent to a free enterprise economy, and prices do a pretty good job of tracking company earnings over time. Gold has proven a useful diversifier, but it’s unclear why its long-term expected return should be higher than more productive assets. On that point, I enjoyed the recent analysis from D.E. Shaw, which poses this idea: “The growth rate of gold’s value should, over ultra-long horizons, equal the rate of global wealth growth. Why? A meaningfully lower or higher rate would imply that, over a sufficiently long period of time, gold’s aggregate value will approach 0% or 100% of global wealth. Neither has happened over millennia.” If Gold’s primary use is as an investment, then its expected return looking something like the growth rate of global wealth makes a lot of sense to me, even as a fairly rough framework.

Gold is not a portfolio growth engine.

Ultimately, Gold can be a valuable asset for a diversified portfolio, and could even potentially prove a more useful one in the world ahead. But, to me, it doesn’t pass the test to be a primary long-term holding, especially as a portfolio growth engine.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.