On the Russia-Ukraine Tensions – Washington Policy Research

With Russian troops officially entering Ukraine from nearly all directions, it is clear a major geopolitical event is at our doorsteps. We take a look at some potential next steps, likely sanctions, and longer-term implications of the action.

Swift Russian Victory or Protracted Resistance?

If Russia’s actions simply ended recognizing two breakaway areas, the impact could be similar to Crimea in 2014: limited sanctions, limited economic fallout. The impact for financial markets would be small, with more pain in Russia than the US. However, Russia has larger intentions and has now entered Ukraine. There are really two paths from here: 1) A swift Russian takeover of the country with a new government installed. This event would be similar to Operation Desert Shield with the lead up to the military event having a larger impact on financial markets than the event itself. Investors will be able to put book ends around potential outcomes; or 2) Ukrainian resistance is stronger than Russia anticipates and the conflict will last longer. Energy and commodity prices are likely to stay elevated, adding inflation pressure and making the Federal Reserve’s job even more difficult.

Sanctions Limited, But More To Come

After a relatively weak first round of western sanctions, the invasion into Ukraine will raise the stakes. We expect the US will impose export restrictions on critical technology and could possibly cut off US dollar access to Russian companies. Restricting Russian securities are also being discussed. Russia has already priced in these sanctions and are unlikely to stop or slow the invasion. Sanctions just make the action more costly.

Energy & Commodities Are Critical

Western countries are trying to hold back on energy sanctions due to rising prices at home and the adverse political ramifications of continued higher inflation. Thus far, no major Russian energy companies have been sanctioned, nor has there been serious talk of reducing imports of energy products from Russia (Russia is the world’s third-largest producer of oil and second-largest producer of natural gas, with Europe being a key consumer). Russia’s actions could have the effect of the US reaching an Iran Nuclear deal to get roughly 1.3 million new barrels of oil into the market. Russia is also a large exporter of other critical commodities.

Investment Ramifications

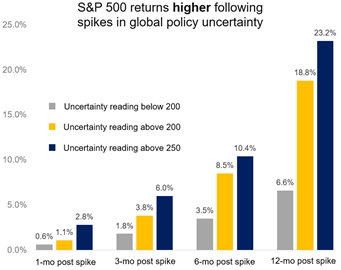

These tensions are decidedly risk-off and should see money flow towards oil and traditional safe havens (e.g. the dollar, US Treasurys, gold) near-term, while weighing on equities and other risk assets. Upward pressure on oil and gas prices could cause a supply shock in oil and further cut into consumer discretionary income, greatly complicating the Fed’s ability to tighten monetary policy. Longer-term, a bit more optimism. Forward returns from periods of elevated uncertainty are actually quite strong (see chart), while returns following other significant historical events have been more mixed. For instance, stocks were up double-digits both one year after Iraq invaded Kuwait and one year after the US-Iraq War began. While geopolitical events can cause uncertainty to spike and sentiment to plummet near-term, they haven’t often resulted in longer-term economic or market pain (though the margin for potential outcomes is wide). In the end, as uncertainty grows, so does the impetus to focus on diversification, financial planning, and long-term outcomes.

Talk to your Baird Advisor today

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.