Understanding The Fed’s Highwire Act

Ross Mayfield

Ross Mayfield

Investment Strategy Analyst, Baird Private Wealth Management

The Federal Reserve has a “dual mandate” of pursuing maximum employment and price stability. But in periods of high and sticky inflation, does that necessarily require the cooling of the economy and resulting job loss? Baird Investment Strategy Analyst Ross Mayfield examines the relationship between employment, inflation and interest rates and the Fed’s challenges in balancing all three.

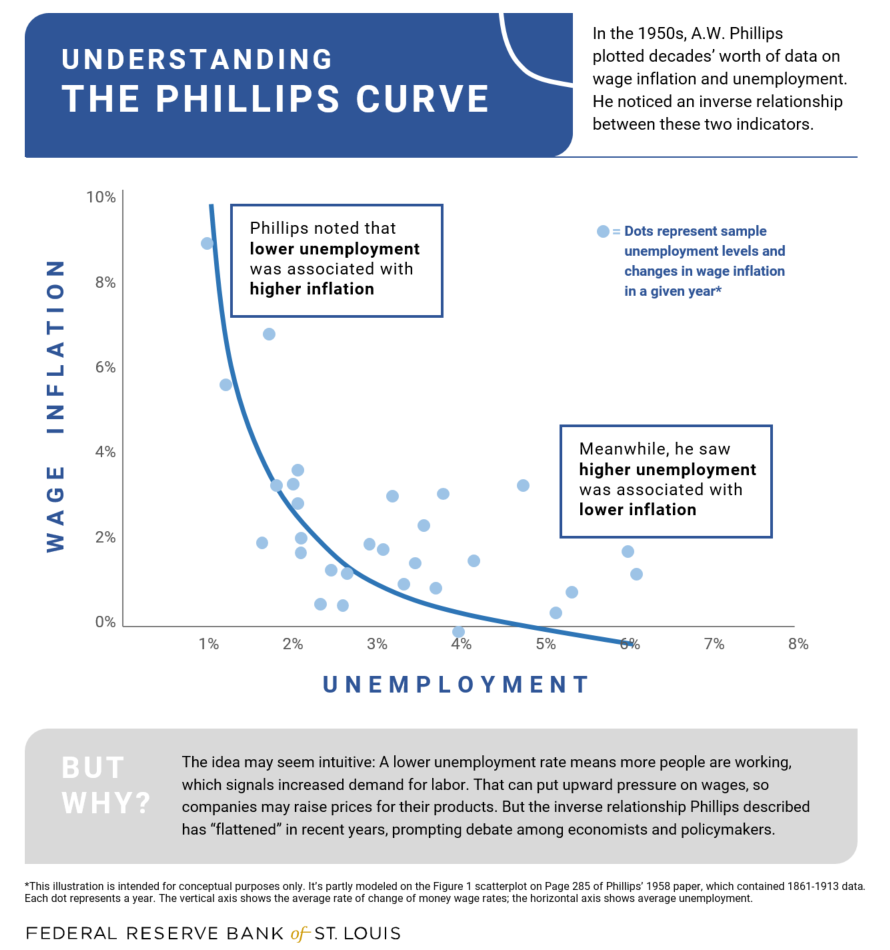

Here’s a simple framework to think about the Federal Reserve: They are an institution with two goals and really only one mechanism to accomplish them (using a few key tools). Their “dual mandate” is price stability (i.e., inflation under control) and maximum employment. The mechanism is controlling short-term interest rates, either lowering them to heat up the economy or raising them to cool it back down. The trick is managing the relationship between the two goals, which are often viewed as antithetical to one another: In theory, lower unemployment puts pressure on inflation via higher wages, while higher unemployment might be deflationary (lower wages, less spending, etc.). In fact, this is the explicit conclusion of the widely referenced and followed Phillips curve, which has been called the “connective tissue between the Federal Reserve’s dual mandate goals.” Based on this idea, the Fed implies that a low-inflation, low-unemployment economy is untenable in perpetuity, and that they must manage things accordingly.

Today, we face a real-world example of this issue. The Fed sees a significant labor market imbalance (i.e., too few workers, too much demand) that they believe is putting upward pressure on wages and therefore prices. Their dual mandate is out-of-balance, and they’ve raised interest rates as a result. But as the Fed’s own projections explicitly lay out, this comes at the cost of jobs. Even Paul Volcker, the famous inflation-slaying Fed Chair of the early 1980s, was not immune to this – though his aggressive interest rate policy ultimately did squash the inflation that had been so persistent for a decade, it came at the cost of two recessions, a generational spike in unemployment and an outright revolt from American farmers.

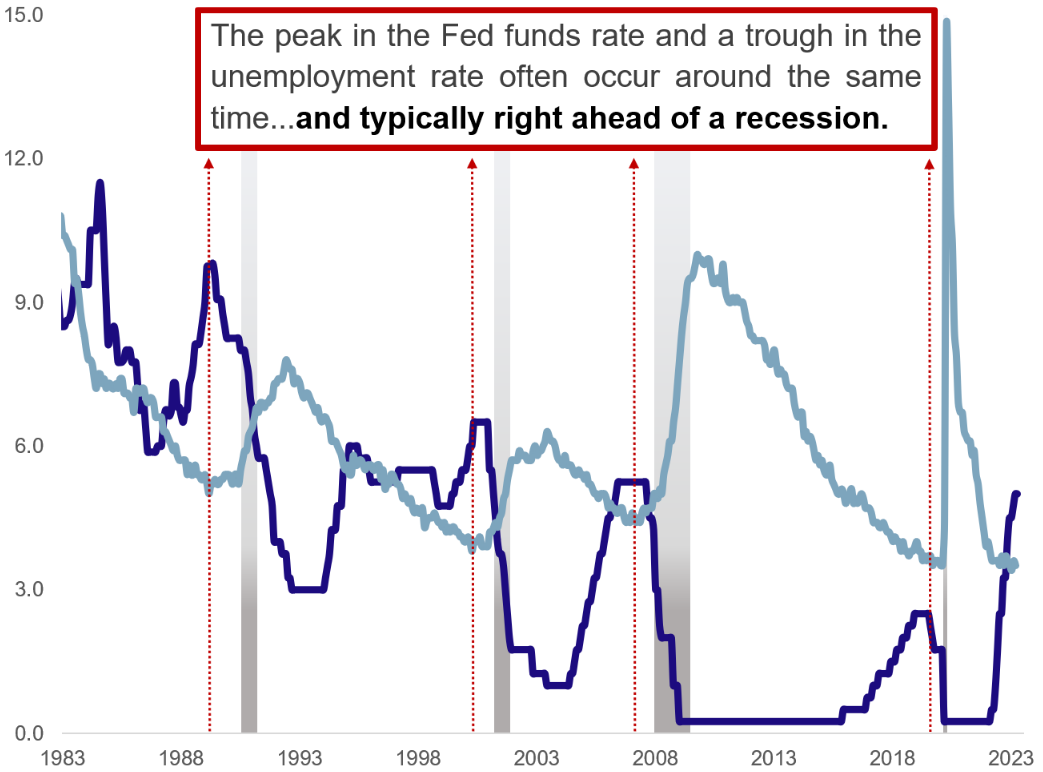

These are the complexities of managing the world’s largest economy. The Federal Reserve aims to maximize employment … right up to the point where a too-hot job market might start pushing up on wages. This is a delicate and almost impossible balancing act. It also helps explain why a cycle low in the unemployment rate can be a harbinger of weakness to come – it is at those moments that the Fed is typically the most concerned about inflation and therefore most willing to raise interest rates, cool the economy down and raise the risk of recession. This is the precipice we find ourselves on today.

And, ultimately, this balancing act – inflation vs. unemployment – is worth discussing. Rising unemployment is awful, but it is more narrowly focused; inflation is a broader scourge and tends to affect lower income workers the most. Of course, this debate also highlights the Fed’s limited toolkit in fighting an often very complex problem. They can raise rates to cool demand for cars or houses or workers, but they can’t open a factory or plow a field.

Addressing both sides of the coin with a broader swath of policy prescriptions would better help solve this bout of inflation, but the Fed alone only has the tools for one.

To date, the labor market has remained resilient in the face of higher inflation and higher interest rates, but rate hikes act with a long and variable lag. The questions now are whether today’s post-Covid economy is any different from past business cycles and, if not, how steep the inevitable rise in unemployment will be. With the Fed likely very close to finished with this rate hike cycle and signs of weakness percolating, we won’t have to wait long to find out.

Check out these investment perspectives for additional insights from Ross and other Baird market analysts. Your Baird Financial Advisor can help make sure your financial plans will have you well-positioned for whatever the market has in store.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.